Memory loss, dementia and your money

Memory loss can make it difficult to stay in control of your money. Things like checking bank statements or investments, or paying bills may become

Memory loss can make it difficult to stay in control of your money. Things like checking bank statements or investments, or paying bills may become

When you think of an investor, what image springs to mind? For many of us it’s a driven day trader, running on adrenalin, hunched over multiple screens,

A pause in super contributions can have long-lasting effects. Here’s how to plan ahead for super breaks. There’s a host of reasons why people take

Understand the rules, costs and risks of setting up an self-managed super fund (SMSF) to invest in residential property. Self-managed super fund property rules You

When and how you can access your super to start an account-based pension. If our working years can be regarded as the time when we

Many women will need to do more to build up their super balances by the time they retire. There’s a plethora of data showing women,

With ample time left before 30 June, now could be a good time to catch up on super. The early part of each year is

Key points: There are varying tenure types that can impact your rights over a property in a village Make sure to understand all the costs

Here are some factors to consider before you join finances with a partner. While you’ve likely imagined what a future with your partner looks like,

Land banking is a real estate investment scheme that involves buying large blocks of undeveloped land. These schemes are often unregulated and there’s little protection

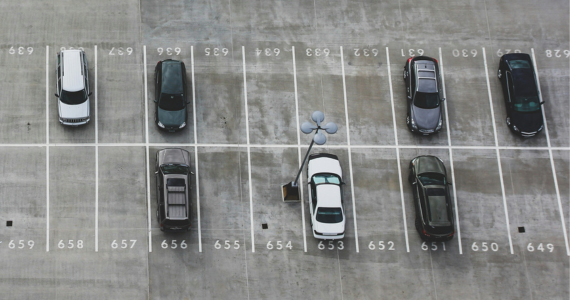

During the past couple of years property investors have been less active as interest rate rises began eating into their profits. However, as 2024 begins,

Consolidating your super means moving all your super into one account. It makes your super easier to manage, and saves on fees. Before you consolidate,